2026 Whisky Investment Trends

Colin Hampden-White

Table of contents

- Introduction

- A Recap of 2025

- New Make On The Block

- India and Beyond: The Outlook

- Japan

- What’s been performing well?

- The 2026 Outlook From Simon Aron - Is whisky a good investment in 2026?

- Do’s and Don’ts for 2026

As the global market for alternative assets continues to expand, whisky investment stands out as one of the most resilient and rewarding opportunities available to modern investors. With rare bottles outperforming many traditional asset classes, whisky has firmly established its position as a stable, long-term store of value.

But what does that mean for 2026? In this article, we explore the key trends in whisky investment and what they mean for collectors, seasoned investors, and newcomers ready to tap into the growing world of premium spirits.

A Recap of 2025

2025 has been a story of consolidation. Some companies have closed and others have cut back on their purchasing and stock. Pricing has gradually levelled out at a lower price per litre and we think 2026 will continue this trend.

This has nothing to do with the quality of the spirit or whiskies’ innovation, creativity, and global reach. Rather it is the combined effects of the post covid boost in sales. This made many producers think they could sell more at a higher price and increase volume too. This gave everybody from distilleries to retailers a false sense of security.

There is an art of predicting a market, but with whisky there are more variables, it is harder to measure. We’re still shocked to see that bottle prices for very old & rare are sometimes, but not always, extremely high. In 2025 cask prices have behaved in a different way, extremely highly priced casks have stabilised, and the demand for top brands of 30 year old plus whisky is still there. Young and medium aged whisky casks also need to reach a good value point.

Independent bottlers and whisky enthusiasts have stood back and watched a market increase to really high levels, and it shocked them, with prices way beyond their budget.

With many economies struggling and higher taxes being imposed, many who spent £120 on a bottle of whisky simply can’t anymore. There are stockpiles of whisky from post covid time which remain unsold. Consumers will still look for interesting and unique whisky, but they will be more discerning across price and quality.

It’s the water of life, but life doesn’t always flow in line with whisky, so what do we think the 2026 whisky investment trends might hold?

New Make On The Block

Due to the Covid bubble highs of 2021-2023, resulting in a decline in exports across 2024-2025, whisky stock management is undergoing adjustments, which has seen a greater variety of new make casks on the marketplace. It could be argued that this recalibration is just the beginning -although the market is slowing down, it is a different market with different rules, and new opportunities.

Export data collected by Alan Gordon’s annual - The Scotch Whisky Industry Review - showed that export of single malt was still above pre-pandemic figures, despite a decline from 2023. Data from the first half of 2025 seems to indicate that this slow down will continue into 2026 and begin to pick up again in 2027, as the industry continues to learn how to steer itself in new waters.

2025 also saw distilleries across Scotland lower their production levels in answer to the market, whilst many had to manage their warehouse stock.

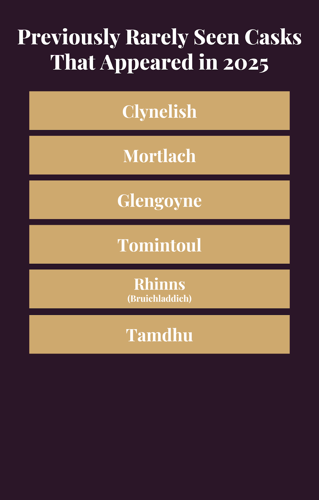

One exciting result of this new landscape is the variety of new make casks coming onto the market. It is giving fans of these distilleries a chance to finally own some of their favourite spirit. It’s also providing an excellent period to diversify a cask portfolio across distilleries, cask type, and flavour profile.

This trend looks set to continue into 2026, with more casks from a greater variety of distilleries coming onto the market at fairer prices. This is good news for buyers and may well lead to a greater opportunity to discover new distilleries in the future. The names on the list are steadily evolving, as different companies take slightly varied approaches, it will be interesting to see what appears next year.

In emerging markets the traditional blends are seeing growth in the middle class sector, whilst high net-worth individuals are discovering more single malt, thanks to social media and the push for more brands to find new markets. Evidence of this can be seen in the increased interest in the likes of Bowmore, Dalmore, and Springbank. There is hope that this increased discovery will complement the variety being seen on the whisky cask investment marketplace, with more demand for these lesser known distilleries in the future.

Key Takeaway:

There are new opportunities that come with a transitional whisky market. An increased variety of casks from some of the best known distilleries is proving to be one of those in 2025 and this looks set to continue in 2026. It is still wise to choose distilleries that combine provenance and quality spirit, with strong current investment in emerging market distribution and brand equity.

There is also no guarantee a distillery that is popular today, will be just as sought after in 20 years time. Rarity will always command the most premium returns at the most costly prices. However, an informed decision in discussion with your account manager, can help identify where there is room for growth.

India and Beyond: The Outlook

The UK’s trade deal with India announced that the 150% tariffs on whisky will be reduced to 75% next year and to 40% across ten years. But who really benefits? Is the focus on India distracting buyers from more stable emerging markets?

India is a country with a deep cultural affinity for whisky, its status here has seen it take over France as the world’s largest consumer of whisky by volume. But beyond the numbers, it’s the shifting tastes, booming middle class, and evolving domestic industry that are shaking up global markets, and creating opportunities beyond tariff headlines.

India’s whisky market is complex - for years, local brands dominated the scene, many of which are technically closer to rum. These are molasses based spirits, such as Imperial Blue and Royal Stag, labelled as whisky due to regulatory loopholes.

The big players who have brands in this space view them as a stepping stone to the aspirational Scotch. The journey usually takes in some 100 Pipers or Black & White - Scotch bottled in India that can avoid the tariffs of that bottled in Scotland.

Following this, there’s an upgrade blended Scotch such as Ballantine’s and Johnnie Walker. Beyond that there’s single malt Scotch - where The Glenlivet is number one, followed by the likes of Macallan, Lagavulin, and Talisker.

This has coincided with rising affluence among urban consumers, whose thirst for authentic, premium experiences, is turning whisky into a badge of status, rather than merely a social lubricant. The hope is that reduced tariffs will open up more single malt Scotch to Indian consumers, helping grow demand. An increase in demand, that in ten years time, could have space for an independent bottle market and benefit cask prices.

But in the last decade, a quiet revolution has been underway. Distilleries like Amrut and Paul John have produced award winning single malts, with the relatively new Indri hitting the sweet spot with its modern branding. The Times of India reported that in 2023, 345,000 cases of the 675,000 cases of single malt sold in India were of Indian origin. The lower price point is a large factor, but it also coincides with two Indian trends over the same period - national pride and a rising influence of young consumers, who want to buy Indian.

This shows that although Scotch may be the gold standard, as in many other industries, emerging markets are no longer passive recipients. They are taste makers, innovators, and increasingly, competitors. Instead, co-branding, and local collaborations, could prove a winning blend of authenticity and appeal.

For now the lowering of tariffs will only benefit the established big blends such as Johnnie Walker, Chivas Regal, Ballantine’s, and other blenders, two of which have already shifted to being bottled in India to compete with the price point of local brands. There is currently little room for small, imported brands that hold no sway with Indian drinkers.

But while India offers tantalising volume for bigger brands, the real premium growth may be happening elsewhere, in emerging markets like Dubai, South Korea, and Vietnam.

In Dubai, whisky has become a key signifier of status among a new generation of globalised professionals. What was once a luxury for Western ex-pats is now a cross-cultural symbol of cosmopolitan taste. This increase in popularity has seen Whisky Live visit the country as Malt Live, Cask Trade joined in this year and were blown away by the execution of the event.

South Korea, a long time consumer of luxury single malt,

have embraced whisky in high-ball form, driven by trends in fashion, K-drama, and night-life - that mirror Japan’s whisky trends. Further south, Vietnam’s youthful middle class is also turning to whisky as a marker of modernity, with a rapidly expanding appetite for both single malt and blends.

For Scotch producers, these markets offer something India struggles to match: clarity. Tariff regimes are stable, supply chains are less convoluted, and luxury consumption is culturally aligned with premium spirits. In short, they offer not just volume, but value.

Another stand out market from last year was Türkiye, where whisky fans and influencers have taken Scotch whisky into the 21st century, and turning it into a drink that young aspirational professionals want to enjoy. The popularity among aspirational professionals is also an economic decision. With duty on all alcohol sitting at around 70%, drinkers are opting to buy a bottle of whisky instead of beer and wine – which are increasingly seen as not worth the price on account of their strength and quality.

This July marked an historic first, with whisky overtaking the local spirit - Raki - for market share. Producers are also creating oak cask matured Raki and smoky variants, with packaging becoming more premium thanks to the influence of Scotch.

Key Takeaway:

The India deal may be politically symbolic, but for now it is only the big blended Scotches that will benefit. Nevertheless, with a more attractive price point and burgeoning middle class, there will be an increase in demand from India over the next ten years, that may have a positive influence on cask prices over the long hold. For now, the real emerging markets are that of the middle east and south east Asia.

Try to understand what flavour profiles and whisky trends make their consumers tick, and look for the distilleries that are most active in these spaces, from taste to billboards. The future of whisky lies in recognising that influence flows in both directions.

Japan

Mature whisky markets around the world have slowed down, paving the way for new kids on the block. But Japan is bucking the trend, albeit differently than before. The Wall Street Journal published an article in March 2025 titled: The Japanese Sake Masters Swimming Against a Rising Tide of Whisky.

According to Scotch Whisky Association figures, Japan ranked as Scotch’s seventh-largest export market by value in 2024 and fourth-largest by volume within the Asia Pacific region. Japan once again proved a crucial destination for Scotch whisky, recording a remarkable 22.9% rise in export volume, totalling 74 million 70cl bottles, up from 60 million in 2023. Despite strong volume growth, the price per bottle fell modestly - an indicator of evolving consumer preferences. In early 2024, Japan surpassed its 2023 import pace, climbing 13.4% in H1 volume, even as value dipped 7.5% in the same period .

This contrast reflects Japanese consumers broadening their scope beyond ultra-premium single malts, increasingly embracing bulk blends, grain whiskies, and core range bottles to fuel high-ball culture and casual drinking occasions.

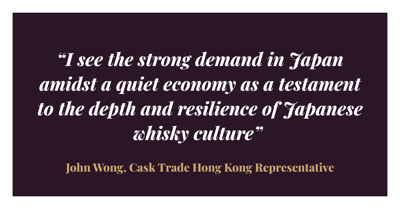

Cask Trade’s representative in Hong Kong - John Wong - says: “I see the strong demand in Japan amidst a quiet economy as a testament to the depth and resilience of Japanese whisky culture. In my conversations with Japanese customers, and with crowds at whisky events such as Whisky Talk Fukuoka, it’s clear they possess a sophisticated whisky background and a strong sense of personal conviction regarding single cask bottlings. They know what they want, there’s ongoing debates on topics like whether Clynelish is best in bourbon casks, or if 1996 Ben Nevis is the star vintage of the ’90s. These lively discussions shape, and sometimes even drive, the direction of the independent bottling scene in Japan.”

John believes that storytelling is pivotal; Japanese bottlers tend to use generous text materials on articulating why a particular cask was chosen, sometimes with elaborate tasting notes, sometimes with a narrative about how this sample stands apart from the rest, or even an interesting anecdote on how a cask tastes nothing like they have expected from the origin distillery.

It should also be noted that old & rare Japanese whisky was produced in such small quantities by a handful of distilleries, that the price of any whisky over 18 years of age is extremely expensive. A Yamazaki 18YO is still around £600 a Bottle.

Key Takeaway:

Scotch whisky’s performance in Japan in 2024-2025 highlights an adaptable market - one that blends tradition with evolving consumer habits. Rising volumes coupled with a dip in value reflects Japan’s deep-rooted whisky culture, whether enjoyed neat or lifted as a high-ball, a well-crafted dram transcends borders and tastes. This may provide an opportunity for bottlers who can provide a product that combines this new need for value with complexity and authenticity, that’s communicated clearly. However, they will be fighting for space against more domestic distilleries than ever before.

What’s been performing well?

We’ve covered off geography, but what about distillery performance itself? The table below showcases Cask Trade sales data from 2019 - September 2025, giving some fantastic insight into some of the top performing casks recently.

Key Takeaway:

Prices have consolidated since the highs of 2023, but casks that have aged 9 years and above still show good returns. This suggests 2025-2026 is a buyers market, where a return to a more moderate long term growth trend (seen before 2021-2023) would still see a good return on casks bought now and held until 9-18 years of age. It is important to remember that the amount of variables affecting the liquid inside an individual cask, means that no two are the same, and cask prices can go up as well as down.

Always have this in mind when researching cask values and making a purchase. You should always research thoroughly by using all the tools available to you - such as Beyond The Cask - but remember that no one can give you an exact growth prediction on your cask when investing in whisky.

The 2026 Outlook From Simon Aron - Is whisky a good investment in 2026?

“The positive news is that cask prices across the old & rare are returning to levels where independent bottlers can now buy again and Cask Trade can source and supply, after almost 12 months of inflated prices.

There is a great deal of excitement in emerging markets such as the UAE, South Korea, Vietnam, and of course India for single malt whisky, that is now being matched with wider investment from the bigger spirit companies. I believe that Japan will come back, albeit with different expectations on price and taste than before.

When it comes to cask ownership, I think 2026 is going to be a buyer’s market. I don’t expect a massive price increase for whisky, and this benefit will be met with an increased variety of distilleries. This makes it a good opportunity to fill gaps in your portfolio, whether it’s a particular age, region, or distillery.

With all of this in mind, it makes it an incredibly dynamic time for the cask marketplace. There are opportunities to pick up a cask that you may never have seen available, but also be involved in a market that is beginning to get back to what it does best, produce outstanding bottles of single malt.”

Do’s and Don’ts for 2026

Do’s:

Research and thoroughly compare any cask company you are thinking of purchasing from, to ensure it has at at three years of solvent and up-to-date accounts at Companies House, in addition to pricing, legitimacy, business practice, accounts, office locations, company story, and HMRC licences.

Think of your purchase as a long hold. The current market has returned to a more modest growth rate - buy with provenance as your watchword and be prepared to wait.

Build a diverse portfolio. Think about hold time and budget, then look at different distilleries and age statements, different wood types, regions, and spirit from different countries.

Have a thorough understanding of your exit options. Understand the implications of divesting via independent bottlers, Auction Your Cask, third-party sales, discretionary buy-backs, consignment on our stocklist, or bottling yourself.

Always check a cask's naming rights. This will affect its value and the options for bottling.

Don’ts:

If it sounds too good to be true, it probably is. Don't be drawn in by companies that promise quick returns, or quote massive profits from examples of old and rare casks.

Don't buy from companies that don't have their own warehouse or a dedicated warehouse. Avoid buying multiple casks from the same year and distillery. If you are buying multiple casks, always diversify with different distilleries and age statements. This minimises risk and gives more flexibility.

Do not spend what you can't afford to lose. Investing in whisky always has risks, so make decisions with care and responsibility. Your account manager should always ask what your budget is before proceeding with any conversations. You should also consider the horizon for your return on investment - don't invest money on which you are not prepared to wait for a yield.

If you’d like to explore your options for investment in 2026 we - Cask Trade - will provide you with fully transparent, expertly managed whisky cask investment services and support from our own team.

What’s even better is that we have a dedicated whisky warehouse, ensuring that every cask under our care is stored safely, securely, and under the ideal maturation conditions. So whether you are an experienced investor or exploring whisky for the first time, our team is ready to guide you through every step of the journey.

Ready to start or expand your whisky investment portfolio?

Get in touch with Cask Trade today and let our specialists help you tap into the most exciting whisky investment opportunities of 2026 and beyond.