Cask Age and Value - Are They Related?

Discover how whisky cask age impacts potential returns later down the line. Learn about aging milestones and exit strategies with expert insights.

Cask Trade

Table of contents

- Introduction

- Time, Science, and Economics

- Understanding Cask age and Potential Returns

- Cask Age and Bottling

- Managing Risk and Reward

- Conclusion

Does a cask's age actually increase its investment potential? With Cask Whisky investment growing in popularity as an alternative investment asset, it’s becoming more important than ever to understand the impact of the casks age in relation to investment.

Many investors look at whisky for diversification, stability and long term return, but unlike other investments it’s also tangible, and passion-led, making it an exciting prospect. Whisky ownership is unique from other alternative investments due to the value of the whisky being tied to the maturation period over time.

Time, Science, and Economics

The whisky process is a long one, and requires decades of knowledge to produce a recipe formulation. A master distiller's responsibility is to understand how the science of the ingredients and how the cask type works together in order to create a unique flavour that stands the test of time.

The aging of the liquid is the most important part to a casks investment potential. When a liquid has initially been formulated its taste is very different to its end product. When poured into its cask the taste will be very clear, sharp and harsh, but over time the spirit interacts with the barrel chosen. This maturation process is what helps the taste and colour become more complex and rounded. Each year gives the spirit more depth and complexity to the taste. This time and patience to create something exquisite is why whisky is considered a premium product.

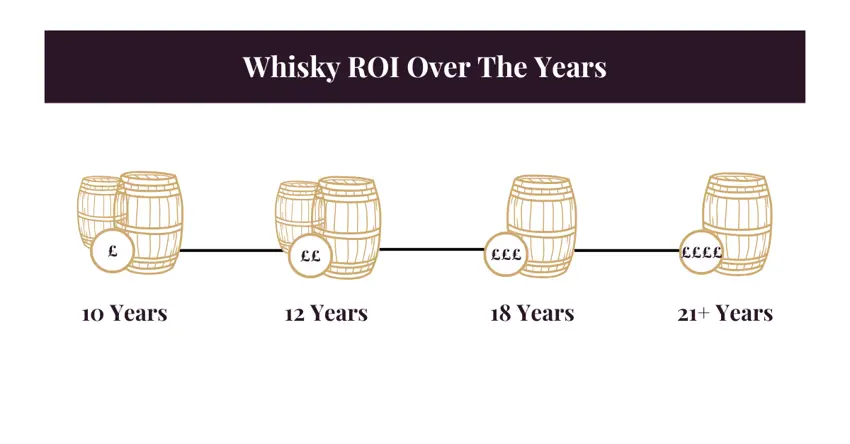

Like with vintage wines consumers believe that age of whisky is related to its quality and status, thus helping to drive up prices. So generally what are the economics in relation to age?

10 Years: The First Consideration Period

A decade tends to be the minimum age at which many single malts begin to be considered for premium bottling as the whisky shows signs of complexity and balance.

Market Position: Plenty available but commands a higher price than a younger spirit.

12 Years: The Quality Mark

Those extra two years can make a big difference, and at 12 years this is often seen as the industry standard for quality. It provides a sweet spot for both drinkers and investors.

Market Position: Casks at this stage are usually in demand.

18 Years: Gains Luxury Status

During this period expect a distinction in both taste and value as fewer casks reach this age.

Market Position: Scarcity drives prices.

21 Years+: Rare and Collectible

The whisky that falls into this sector are ones that are rare and refined. Most often these ones are released in limited editions.

Market Position: Extremely rare meaning you can expect to pay a premium.

When you invest in whisky don’t expect there to be quick wins, you’re in it for the long haul. And there’s a reason for this - craftsmanship takes time.

The aging of whisky is crucial both in and out of the barrel. Aging of the liquid allows it to have a more complex flavour, this develops the longer you leave it. Outside the barrel and in the marketplace, you’ll find older aged whiskies come with quality, rarity and status - all of which drives higher prices.

It’s also important to consider that the value of whisky isn’t always down to its age. It also takes into consideration brand reputation, the master distiller, cask type, market demand and knowing when to exit in order to maximise ROI.

Cask Age and Bottling

When investing in whisky casks you’ll need to consider whether you want to sell the cask as it is or send it off to be bottled and sold as the finished product. When considering this you need to be led by your financial goals and appetite as these options can change your return on investment.

We outline our benefits and considerations of selling an aged cask below:

Benefits:

- Capital appreciation accrued

- Strong market demand in the 10-15 years mark

- Liquidity at peak taste and value

- Avoids over-aging risk

- Lower costs as no storage, insurance, or evaporation loss (angels share)

Considerations:

- Market Timing

- Cask Condition

- Buyer Type

- Exit Strategy Costs

- Emotional Attachment

- Lose out on potential bottling benefits

Selling aged casks as they are tends to be most aligned with risk averse and long-term investors, and also those lacking bottling ambitions.

However if you do decide to bottle the cask it can provide worthwhile returns, but it comes with its risks. It’s seen as highly rewarding but it’s not without putting thought into logistical, regulatory and marketing plans.

We outline our benefits and considerations on bottling a cask below:

Benefits:

- Full control over presentation

- Can set pricing

- Significant potential margins is selling direct to consumer or through retail

- Emotional and branding value for collectors

Considerations:

- Bottling costs (design, packaging, distribution)

- Excise duties and HMRC regulations

- Time and effort required to market and sell

Bottling tends to be most aligned with entrepreneurs, brand owners and whisky enthusiasts who have clear strategies and vision.

Managing Risk and Reward

Like with any investments there are risks and rewards to consider.

Whisky casks tend to be subject to supply and demand cycles, rather than traditional investments in stocks which can suffer from market fluctuations. This demand can be influenced by shifts in global consumption and regulatory changes which can all affect the resale value of a cask.

It’s also important to consider the evaporation loss you’ll have over time, this is called the ‘Angels Share’. As the whisky matures a portion of the liquid evaporates - typically around 1.5-2.5% per year so it’s important to consider this loss over a ten year period. Regauging regularly will help you track your investment and when it’s most appropriate to exit.

Conclusion

Whisky casks as alternative investment is unlike any other asset, it’s a unique blend of patience, provenance, and potential. As casks mature, so too does their value, driven by the natural process of aging and the global appetite for premium aged whisky. But unlocking the full return on investment requires more than just time; it takes knowledge, timing, and the right strategic guidance.

That’s where Cask Trade comes in. We will help you navigate the journey with confidence. Register your interest here.