UK-India Trade Deal - The Impact on Scotch Whisky

What will an import tariff reduction mean for the Scotch Whisky industry, cask owners, and bottlers?

Cask Trade

Table of contents

- The International Scene is Changing

- Lets Distil The Heritage

- A Tale of Two Whiskies

- The Johnnie Walker Effect

- Opportunities for Independent Bottlers

- A Cultural Shift Brewing

- Looking Ahead: A Lucrative Future

The International Scene is Changing

In a story where legacy meets aspiration, and tradition pours into ambition, one spirit has found its way into the heart of a nation. India, a land of rich heritage, deep flavours, and a growing thirst for the finer things in life, has emerged as the world's largest importer of Scotch whisky by volume, even surpassing France who have been long considered a bastion of whisky lovers.

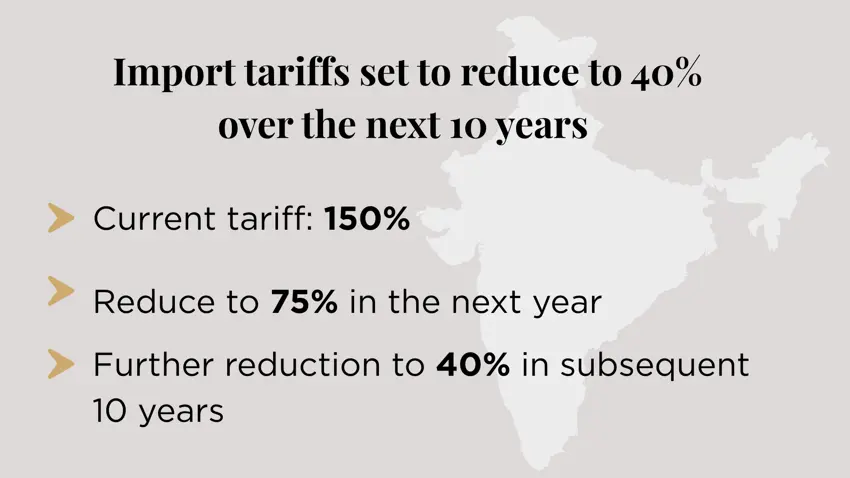

In 2022, India imported a staggering 219 million bottles of Scotch, marking a 60% surge from the previous year. And by 2023, it had officially overtaken France to claim the top spot in volume, according to the Scotch Whisky Association (SWA). This rise in consumption comes despite a steep 150% import tariff, a barrier that until recently kept prices high and accessibility low.

But things are changing.

With the recent UK-India trade agreement, that towering tariff is set to be halved to 75%, unlocking a cascade of opportunity, for producers, exporters, bottlers, and, most of all, Indian consumers.

Lets Distil The Heritage

In India, whisky is not just a drink, it’s a cultural icon. A legacy passed from one generation to the next. At high-society weddings, single malts are gifted to guests. In Bollywood, Scotch flows freely in scenes of opulence. In urban clubs and homes of the wealthy, rows of imported bottles remain under lock and key.

Yet for all its prestige, Scotch whisky occupies just 3% of India’s total whisky market. The real story lies in its dominance of the premium segment. Here, it accounts for a whopping 85% of all high-end liquor consumed.

A Tale of Two Whiskies

India’s whisky demand is complex. In 2021 alone, the country imported 25 million bottles of “bottled blend” Scotch and 108 million bottles of “bulk blend”, reflecting a strong preference for affordable options. Much of the bulk whisky is shipped to India, mixed with local spirits, and bottled under blended labels like 100 Pipers and Royal Stag.

Unlike the strict definitions maintained in the UK or EU, India’s regulatory environment permits whisky to be labelled as such, even when it’s partly made with neutral spirits like molasses-based alcohol. This looser definition has opened the door to massive market volume, but it’s the trade deal that may reshape the nature of what is consumed.

Now, with tariffs dropping, single malt Scotch whisky, the apex of the category, may become affordable to India’s burgeoning middle class. For decades, only the wealthy could indulge in a bottle of Lagavulin or Glenlivet. But as prices fall, a bottle of Johnnie Walker, once sold in India at around £60, could now be found for £40 as a result of the new tariff reductions. Though still expensive compared to locally produced spirits, that reduction will put imported Scotch within reach of tens of millions more consumers.

The Johnnie Walker Effect

There’s one name that perhaps best captures Scotch’s identity in India, Johnnie Walker. The brand is more than a bottle; it’s a badge of arrival. As with tea and cricket, it has woven itself into the fabric of modern Indian identity.

Owned by Diageo, Johnnie Walker is a blend made from up to 42 different whiskies, drawing not only from Diageo’s 29 distilleries, but from all over Scotland. The increase in Indian consumption means that more casks will be needed, not only for blending but for bottling and distribution as demand grows.

This presents a unique knock-on effect: the UK cask market stands to benefit. With Indian importers, hospitality groups, and independent bottlers now facing lower entry costs, cask owners in Scotland will have more opportunities to bottle and sell. A cask that may have once sat in a warehouse for years could now find its way into a bottle destined for New Delhi or Mumbai.

Opportunities for Independent Bottlers

For years, smaller Indian businesses dreaming of launching their own Scotch whisky labels faced insurmountable tariff costs. But now, the doors are opening.

From boutique hotels to premium bars, businesses can explore exclusive bottlings, private-label blends, and limited-edition malts. Independent bottlers, those smaller players who specialize in sourcing unique casks, will find India increasingly attractive, especially as interest grows in rare and aged spirits.

With tariffs lower profit margins also grow, making it viable not just for the Johnnie Walkers of the world, but for smaller Scottish distilleries and exporters to gain a foothold in one of the planet’s fastest-growing alcohol markets.

A Cultural Shift Brewing

A question lingers - if Scotch becomes more affordable, will it lose some of its exclusivity, the very quality that made it aspirational?

Some say yes. The cachet of owning something rare or expensive is part of its charm. But others argue that the premium perception of Scotch, particularly single malts, will endure. Local blends may lose some of their appeal, but a bottle of 18-year-old Macallan will still turn heads at an Indian celebration.

Moreover, India’s younger generation resonate with quality, experience, and individual taste. They are exploring gin, vodka, and craft cocktails, but Scotch remains a staple, partly because it’s simpler to appreciate than wine, which often feels more intimidating due to vintage, grape, and climate factors.

Looking Ahead: A Lucrative Future

The Scotch Whisky Association projects that with reduced tariffs, India could import an additional £1 billion worth of Scotch over the next five years. If that materializes, it won’t just shift market dynamics, it could reshape the global Scotch landscape.

Cask investment, bottling infrastructure, brand storytelling, and export logistics are all expected to evolve. India, once a distant market for many smaller Scotch producers, may become their most critical audience.

For now, the signal is clear: Scotch has not only survived in India, it has flourished. And with the floodgates opening, the next chapter in this spirited relationship is about to be written, one dram at a time.